child tax credit 2022 income limit

For 2022 the maximum earned income tax credit amount you. Tax Return for Seniors.

Pdf Tds Declaration Form 2021 22 Pdf Download Income Tax Declaration Career Development

Nonresident Alien Income Tax Return.

. Instead of the Cayman Islands lets say that your 3-year assignment placed you in Bulgaria a low-income tax country with flat 10 rateThis time you would be eligible for a Foreign Tax Credit because you are paying income taxes in Bulgaria. A Child Tax Credit. A tax deduction simply reduces the amount of income that you must pay tax on.

US Individual Income Tax Return. And unlike the earned income tax credit you dont need to have earned income to qualify. MAXIMUM CREDIT INCOME LIMIT.

A 1000 tax credit cuts your tax bill by 1000. The upper age limit. Best Luxury Cards of 2022.

Reporting on Your Tax Return. 3600 per child under 6 years old. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees.

The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and from 2000 to 3600 for children under the age of 6. To the upper age limit and to. The full credit can still be claimed on a 2021 individual tax return during the 2022 tax filing season.

If you received advance monthly child tax credit payments IRS Letter 6419 helps you prepare your 2021 tax return and get the rest of your child tax credit. All working families will get the full credit if they make up to 150000 for a couple or 112500 for a family with a single. Ways the 2022 child tax credit would differ from the 2021.

How you could be affected may depend on your income tax return filing status child custody. The earned income tax credit also called the EITC or EIC is a refundable tax credit for low-income and moderate-income taxpayers. SINGLE HEAD OF HOUSEHOLD OR WIDOWED INCOME LIMIT.

For more Child and Dependent Care Credit information see. IR-2022-106 Face-to-face IRS help without an appointment available during special Saturday opening on May 14 IR-2022-105 IRS provides guidance for residents of Puerto Rico to claim the Child Tax Credit IR-2022-91 Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest. Or Form 1040-NR US.

A tax credit however directly reduces your taxes dollar for dollar. Not too late to claim the Child Tax. However the Foreign Tax Credit is likely to be less beneficial than the Foreign Earned Income Exclusion because.

3000 per child 6-17 years old. Tax Return for Seniors or Form 1040-NR. If you qualify for the credit complete Form 2441 Child and Dependent Care Expenses and attach to Form 1040 US Individual Income Tax Return Form 1040-SR US.

A 1000 deduction for example might reduce your tax bill by only 150 or 200 depending on your tax bracket. Best Credit Cards for Restaurants and Dining Out of 2022.

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Statutory Filings In Selaiyur In 2022 Online Taxes How To Plan Financial Goals

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

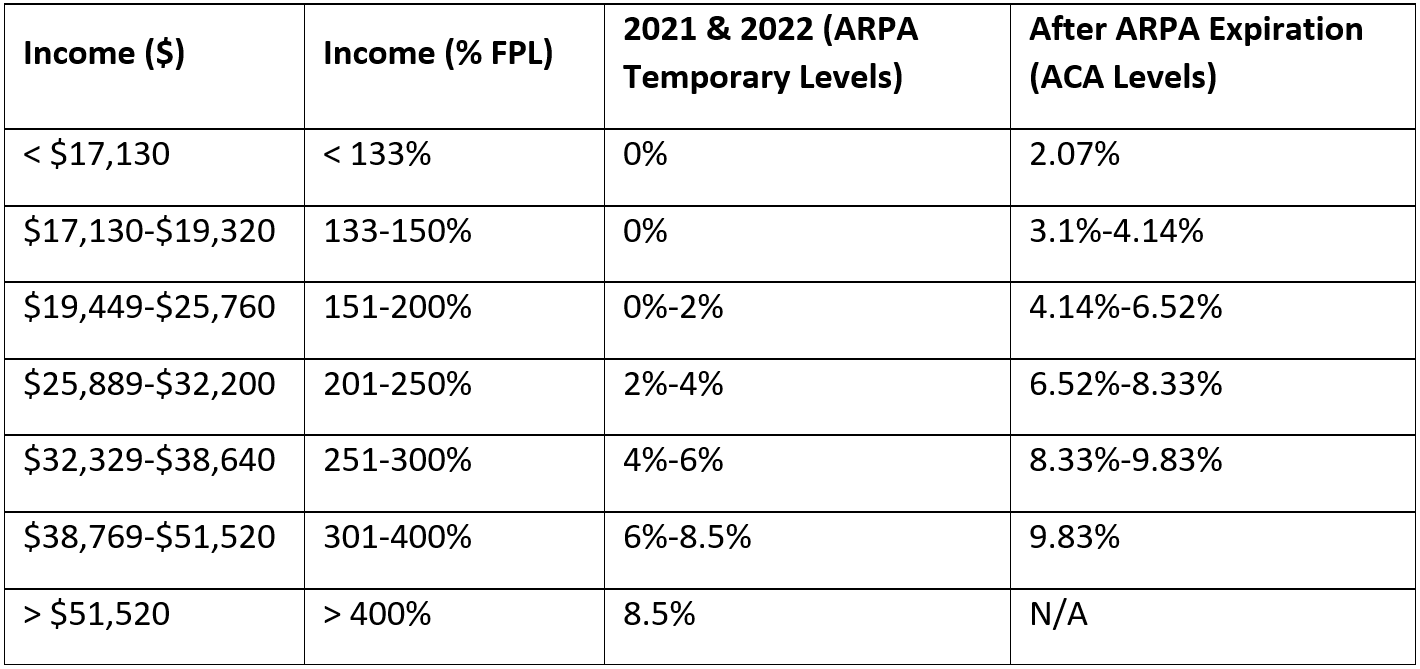

After The American Rescue Plan S Enhanced Premium Tax Credits End Aaf

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Child Tax Credit 2022 Update 750 Payments Available To Americans But You Have To Apply Soon Deadline Date Revealed

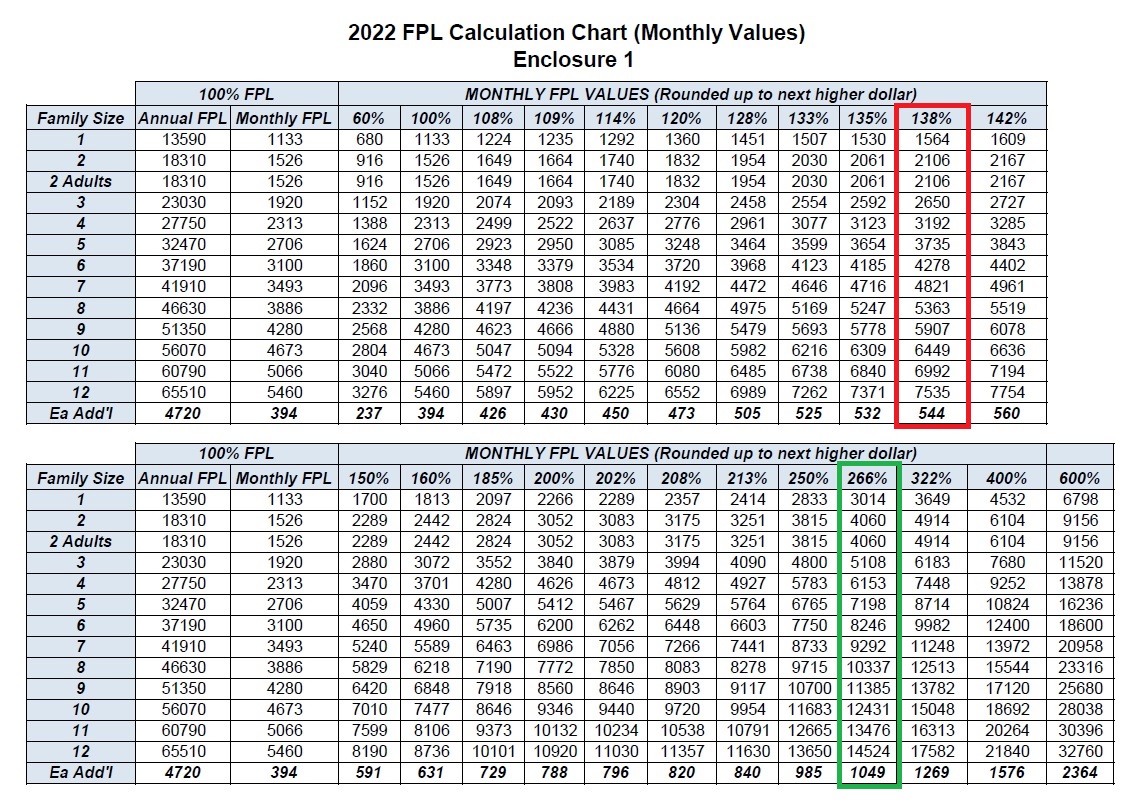

Big Increase For The 2022 Medi Cal Income Amounts

Who Has To File Income Tax Return Mandatorily You May Be Liable To File Your Income Tax Return Itr This Time Even Income Tax Return Income Tax Filing Taxes

Income Tax Brackets For 2022 Are Set

What S The Most I Would Have To Repay The Irs Kff

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Pin By Susan Bucki On Home Health Tips In 2022 Adjusted Gross Income Tax Credits Income Tax Return

What Families Need To Know About The Ctc In 2022 Clasp

Budget 2019 Revised Section 87a Tax Rebate Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

Pin By Mariela Morales On Low Income In 2022 Low Income Income Alameda County

Income Limits For This Little Known Tax Break Are Set To Rise For 2021 Business Tax Deductions Tax Credits Small Business Tax Deductions